How Hard Is It To Get 501c3 Status

Complying with bylaws, attaining and maintaining tax-exempt status, managing a Board of Directors… Starting and registering a nonprofit can seem like a complicated and daunting job. Still, equipped with the correct data and a resilient approach, the process is easier than it seems.

This is non to say that establishing a nonprofit is without its challenges. Starting a nonprofit requires strategy, planning, commitment, and organizational skills. Not to mention, years of hard piece of work and strong willpower are required to sustain a successful nonprofit in the years to come up…

When establishing a new nonprofit, the offset stride for most organizations is to apply for the official 501 (c)(three) status.

What is a 501(c)(three)?

Section 501(c)(3) is the part of the US Internal Revenue Lawmaking that allows for federal tax exemption of nonprofit organizations. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other types of organisation exempt from federal income revenue enhancement under section 501(c)(three) of Championship 26 of the United States Code.

Organizations must be considered "charitable" by the IRS to receive a 501(c)(iii) classification. According to the IRS, a charitable organization is i that has been established for the below purposes :

- Religious

- Charitable

- Scientific

- Testing for Public Prophylactic

- Literary

- Educational

- Fostering national or international amateur sports, and

- Prevention of cruelty to animals and children

Organizations that too help the poor and underprivileged, assist erect or maintain public buildings or national or country monuments, promote civil rights, and gainsay juvenile delinquency and urban decay can too exist considered nonprofit organizations.

At that place are many reasons why organizations choose to apply for the official 501(c)(3) status.

iii Main Types of 501(c)(three) Organizations

one. Public charity

A public charity, identified by the Internal Revenue Service (IRS) as "non a private foundation", must obtain at to the lowest degree i/iii of its donated revenue from a fairly wide base of public support, i.east directly or indirectly, from the general public or from the government. Public support must be adequately broad, not express to a few individuals or families, it can be from individuals, companies, and/or other public charities.

Public charities are defined in the Internal Acquirement Code under sections 509(a)(0) through 509(a)(4).

Donations to public charities tin can be tax-deductible to the individual donor upward to 60% of the donor's income. In addition, public charities must maintain a governing body that is mostly fabricated up of independent, unrelated individuals.

Too read: Everything You Demand to Know virtually 509(a)(1) Public Charities

two. Private foundation

A private foundation, sometimes called a non-operating foundation, receives most of its income from investments and endowments. This income is used to back up the work of public charities through grants, rather than being disbursed directly for charitable activities. They are not required to exist publicly supported, so revenue may come from a relatively small number of donors, even single individuals or families.

Individual foundations are defined in the Internal Acquirement Code under section 509(a) as 501(c)(iii) organizations, which do not qualify every bit public charities.

Donations to private foundations can be revenue enhancement-deductible to the individual donor upward to thirty% of the donor'due south income. The administration of a individual establishment can be considerably more firmly held than in a Public Clemency.

3. Private operating foundation

In general, a private operating foundation is a private foundation that devotes most of its resources to the agile conduct of its exempt activities.

These associations oft maintain active programs similar open charities however they may take traits, (for example, close assistants) like an establishment. Thus, private working foundations are regularly viewed as half-breeds. The majority of the income must get to the conduct of the program.

A private operating foundation is whatever individual foundation that spends in whatever event 85 percentage of its counterbalanced net gain or its base speculation render, whichever is less, straightforwardly for the conduct of exempt activities.

On acme of that, the foundation has to see one of the following tests:-

- the assets test

- the endowment exam

- the support examination

Also, Contributions to private operating foundations as described in Internal Acquirement Lawmaking(IRS) section 4942(j)(iii) are deductible by the donors to the extent of l percent of the donor's adjusted gross income.

Hither's a short video tutorial on How to Get-go a 501(c)(3) Nonprofit Organization in x Steps:

9 Pace Process to Start a 501(C)(iii) Organization

- Stride-i: Get clear on your purpose

- Footstep-2: Deciding the type of nonprofit

- Step-iii: Proper name your nonprofit

- Step-4: Class a Lath

- Footstep-5: Permit's write the Bylaws

- Step-6: File your incorporation paperwork

- Step-seven: File for 501(c)(3) tax-exemption

- Stride-8: Ensure ongoing compliance

- Stride-nine: Get Donations

To help you move through the motions of establishing a nonprofit, we've detailed out a guide beneath – with a special focus on how to start a 501(c)(3) nonprofit organization.

Stride one: Get clear on your purpose

At offset glance, this might not seem similar an essential task when discussing the practicalities of registering a nonprofit. However, getting articulate on your purpose is essential.

A clear purpose motivates staff and volunteers, attracts donors and supporters, and helps build a positive image amongst the full general public.

Once you're able to conspicuously and succinctly communicate your purpose, every subsequent step volition be simpler – especially Step 2.

To get articulate on the purpose of your system, information technology helps to ask yourself the basic investigative questions: Who, What, Where, When, Why, and How:

- Who is it that my organization will bear upon, who are our intended beneficiaries? Who'south going to administer our services? Who are the stakeholders that will help support our mission? Who are my Board members and potential staff and volunteers?

- What is the mission of my organization? Identify the "trouble" you're trying to solve. What values volition bulldoze my arrangement's activity?

- Where will nosotros accomplish our mission, where will the activities take place? Is it a local initiative, a land or regional project, or national/international in scope?

- Why am I starting this nonprofit?

- How volition I accomplish my mission? How will we enhance funding for operations?

Once you have the answers to these questions, yous can brainstorm to flesh out a articulate mission statement and a ane to three-yr plan of action for your arrangement.

Pro tip: Don't rush the procedure. Spending some time now to become clear on your purpose volition pay off afterward. Reflect on the information you gather, write more than than 1 draft, and gather feedback from primal stakeholders.

Step 2: Decide what type of nonprofit yous want to constitute

If you've completed stride 1, this step should exist relatively like shooting fish in a barrel. Based on your nonprofit's purpose, determine which type of nonprofit you want to register every bit (e.one thousand. arts, charities, teaching, politics, religion, enquiry).

You lot must fall into i of these eight broad categories in society to utilize for revenue enhancement exemption:

- Charitable (including poverty relief, combating discrimination, advancing education, etc.)

- Religious

- Educational

- Testing for public prophylactic

- Literary

- Youth/amateur sports contest

- Scientific

- Cruelty prevention for children and animals.

There are 29 types of nonprofit organizations that can file for tax-exemption nether section 501(c) of the Internal Revenue Code. The most mutual of these is the 501(c)(3), which includes all charitable, religious, scientific, and literary organizations. Other types of tax-exempt nonprofits fall under different 501(c) codes such equally:

- Fraternities: 501(c)(viii)

- Social and Recreational Clubs: 501(c)(7)

- Merchandise associations and Chambers of Commerce: 501(c)(6)

- Agriculture or Horticulture organizations: 501(c)(5)

- Social Welfare Groups:- 501(c)(four)

If your nonprofit identifies with one of the to a higher place or another type of organization, yous tin can view the whole list here.

If you are non sure most 501(c)(3) or 501(c)(iv), don't forget to check out our in-depth guide on the same. Yous can likewise read this in-depth checklist while starting your nonprofit organization.

Pro tip: Plan for startup costs for your nonprofit. For example, depending on your state, incorporation can cost yous from $eight (Kentucky) to $270 (Maryland). If yous intend to start a 501(c)(three), await to pay between 275$ if y'all fill out the simpler Form 1023-EZ and $600 for the more complex Form 1023 (which has more detail).

Step 3: Name your nonprofit

Every country in the Us has unlike rules and regulations when it comes to establishing a nonprofit. However, it'southward safe to say you should select a name that's unique and somehow related to the primary activities of your nonprofit.

This determination will set the tone and influence your nonprofit'due south brand for years to come. Then it's smart to take some time to recollect through this decision.

Brand sure your nonprofit'southward proper noun is like shooting fish in a barrel to say and remember. Use descriptive words, but try not to overdo it or brand information technology too long. Don't employ technical/industry-specific jargon. Abbreviations are proficient if yous utilize them well.

If y'all're stuck on the proper noun:

Endeavour brainstorming with your team or your friends and acquaintances. Run into which names sound more than inspiring or which ones are more memorable. Remind yourself of what your nonprofit's mission is, what your main activities are, who your members are, or fifty-fifty where you're located. It might be a good idea to check the availability of web domains since that may impact the name y'all decide on.

If there's a quality domain name available for purchase, we suggest buying it right away – fifty-fifty if you're not launching a website soon.

Many states require that nonprofits have a corporate designator, such as Incorporated, Corporation, Company, Limited, or their abbreviations (Inc., Corp., Co., and Ltd respectively). Cheque your country's incorporation web folio to see if a corporate designator is required for your nonprofit.

When you have selected your name, you demand to check with your Secretarial assistant of Land to come across if it is available and the U.S. Department of Commerce website to be sure the name you want is not trademarked.

Pro tip: Your state's corporation'south part can tell you how to find out whether your proposed name is available for your use. For a pocket-sized fee, you can usually reserve the name for a curt period of time until you file your articles of incorporation.

Stride 4: Course a Board

Forming a Board before incorporating is generally a proficient idea. Some states crave that you lot list the names of your Board members in your incorporation documents. Even if your state doesn't crave this, recruiting a Board prior to incorporating is helpful.

Your Lath tin help yous with the incorporation and the remainder of the sometimes challenging process of establishing a 501c3. Hiring the correct Board is essential to the success of your nonprofit.

Who the "right" Board members are volition depend on your nonprofit. Notwithstanding, whatever the size or the purpose of your nonprofit – information technology'southward essential to rent Board members who are dependable, committed, and aligned to your mission and values.

Another important signal, as The Nonprofit Answer Guide mentions, is your Board should be fabricated up of individuals who have expertise and resources in different areas.

A good dominion of thumb when recruiting is:

- 1-third from individuals who accept admission to fiscal resources or soliciting donations.

- Ane-third from individuals with direction expertise in areas of financial, marketing, legal and the like.

- And i-third from individuals connected at the community level, with expertise in your service field.

Accept time to define their roles and job descriptions earlier starting with the recruitment.

Information technology might too be helpful to create some onboarding files or an orientation guide for your new Board members. You could also create a welcome event where everyone could go to know each other.

Here's a detailed guide on How to Hire a Great Nonprofit Executive Director

Step five: Write upward your bylaws

The bylaws contain the operating rules and provide a framework for your management procedures. They are the tools of internal accountability and they outline the inner workings of your nonprofit.

The power to adopt, amend or repeal bylaws is vested in the Lath of Directors. This is unless otherwise provided in the manufactures of incorporation or in the bylaws.

Bylaws contain the rules and procedures for things like holding meetings, electing directors, appointing officers, and taking care of other formalities.

Note:

An organization that is exempt from federal income tax, as described in Internal Revenue Lawmaking 501(c)(3), is required to written report changes to its bylaws and other governing documents annually to the IRS on the organization's IRS Course 990 – which is part of ensuring ongoing compliance.

Experience free to look up bylaws templates online. Still, annotation that not all templates incorporate the required elements to obtain tax-exempt status. In lodge to obtain the 501(c)(iii) status, you must include language in your articles of incorporation specifically stating that:

- The corporation's activities will be limited to the purposes gear up out in section 501(c)(3) of the Internal Revenue Code.

- The organization will not appoint in political or legislative activities prohibited nether department 501(c)(3).

- Upon dissolution of the corporation, any remaining assets will be distributed to another nonprofit, authorities agency, or for some other public purpose.

MeetIRS Publication 557 for more detailed guidance andsample linguistic communication.

Contact your state part, (commonly the Secretary of Country) that oversees incorporation and ask for a template for your bylaws that y'all can use.

Step 6: Prepare and file your incorporation paperwork

Having chosen a name for your nonprofit and appointed a Board of Directors, completing and filing your incorporation paperwork should be simple.

Within your incorporation paperwork, you will be officially declaring your organisation's name, location, purpose, the initial Board of Directors, and more.

Y'all must file "articles of incorporation" with your land's corporate filing office. Experts recommend that you comprise in the state where you volition deport your nonprofit's programs or services.

If you desire to comprise into another country, you would need to register and utilize for split revenue enhancement exemptions in each state in which y'all acquit activities.

Filings and fees will vary by land. Incorporating a nonprofit does not go far 501(c)(iii) exempt. The IRS requires you to include specific language in your articles of incorporation for those intending to apply for federal revenue enhancement-exempt status.

Subsequently completing your paperwork, y'all will be ready to send them to your country filing part (in most cases, this is your secretary of state.) The requirements volition vary from state to state. Some may want you to submit your articles electronically, others may ask for multiple copies sent via postal service, etc. Afterward filing your articles, many states also require you to publish a detect of incorporation with your local newspaper.

Note:

Obtain a federal employer identification number (EIN) prior to applying for 501(c)(3) revenue enhancement exemption, even if you don't take employees. You tin exercise this quickly and easily. For information on how to utilise for an EIN, including information well-nigh applying online, visit the IRS website at www.irs.gov .

EIN will be used to track your organization's financial activity and make it possible to open a concern bank account and to hire paid employees. Pretty much every major transaction your nonprofit engages in will require an EIN.

When the state approves your articles of incorporation (sometimes this needs to exist done earlier), you should organize your first official board meeting. The chair of the coming together should report to the Board that the country has canonical the articles. At this point, the board needs to make the Articles of Incorporation role of the official record. This coming together is normally referred to as the "organizational meeting" of the organization. The minutes of this meeting is simply a formal tape of the proceedings and actions taken, such equally setting an accounting period and tax year, blessing the issuance of memberships, authorizing and establishing the Board and other committees, approving the bylaws, approval the opening of a corporate bank account, and more.

Footstep seven: File for 501(c)(3) tax-exempt status

Y'all use for exempt condition with the Internal Revenue Service (IRS) for recognition of tax exemption past filing IRS Form 1023. To become the most out of your revenue enhancement-exempt status, file your Form 1023 within 27 months of the date you file your nonprofit articles of incorporation.

Exist aware, the user fee volition be $275 or $600, depending on your awarding method. You must register an account at pay.gov and pay a registration fee with a credit or debit bill of fare. It likewise can accept 3-12 months for the IRS to render its determination, depending on how many questions the IRS has about your application. That's why many experts advise starting with this process as soon as possible.

Form 1023 itself is up to 28 pages long. With the required attachments, schedules, and other materials that may be necessary, information technology is non uncommon for these submissions to the IRS to be up to 100 pages. Think of Form 1023 as an audit of proposed (and/or previous) activity and a thorough examination of your nonprofit'south governing structure, purpose, and planned programs. The IRS is looking to brand sure that the organisation is formed for exclusively 501(c)(3) purposes and that its programs are designed to fulfill these stated purposes. In addition, the IRS is looking closely for conflicts-of-interest and the potential for benefit to insiders, both possible grounds for deprival.

It is as well possible that you can utilise a shorter application form (1023-EZ):

- Class 1023: The traditional 26-folio awarding that is used past larger nonprofits

- Form 1023-EZ: A condensed 3-page application that can exist used past organizations with gross receipts of less than $l,000 and less than $250,000 in assets

Check the IRS website and instructions to the form which include an Eligibility Worksheet you must complete to make up one's mind if your nonprofit meets the requirements for using the shorter streamlined form.

You lot must also include your nonprofit articles of incorporation and your bylaws with this application.

So, before you start filling out form 1023, be sure yous take:

- Filed your articles of incorporation

- Prepared your bylaws

- Held your kickoff nonprofit meeting

The IRS is going to ask for some specific details to exist documented in your application. So be ready to spend a few days filling out this class and gathering your resources. Your manufactures of incorporation and/or your bylaws are going to have to include:

- a statement of your exempt purpose(south), (such equally charitable, religious, educational, and/or scientific purposes)

- a dissolution clause

- a conflict of interest clause

Also, set up to give detailed answers about and/or include:

1. Basic information

This includes the name of your nonprofit corporation, contact information, and when you filed your articles of incorporation.

2. A copy of your articles of incorporation and your bylaws added to the application form.

iii. Clauses every bit follows:

- a clause stating that your corporation was formed for a recognized 501(c)(3) tax-exempt purpose (eastward.m., charitable, religious, scientific, literary, and/or educational), and

- a clause stating that any assets of the nonprofit that remain afterwards the entity dissolves will exist distributed to some other 501(c)(3) tax-exempt nonprofit — or to a federal, country, or local government for a public purpose.

iv. A detailed, narrative description of all of your organization's activities.

Include a description of past, present, and time to come activities – in their society of importance.

5. Information about all proposed compensation to, and financial arrangements with:

- initial directors

- initial officers (such as the president, primary executive officer, vice president, secretary, treasurer, chief financial officer, or any other officer in your organisation)

- trustees

- the five top-paid employees who will earn more than $fifty,000 per year, and

- the five meridian-paid independent contractors who will earn more than than $fifty,000 per year

6. A statement of revenues and expenses and a balance sheet.

*The IRS says that yous should wait to hear from them inside 180 days after submitting your awarding. The IRS goes over your application thoroughly, and if the information is incomplete, the agency may take to contact you lot. This may considerably slow downward the process, which is why it's crucial to be every bit prepared as possible before submitting the application.

Note: Yous might want to hire a lawyer who volition help you with this process. Alternatively, yous could work with one of the companies that assist in this area, such as Nolo.

Pro tip: 40 states likewise require Charitable Solicitations Registration which is usually administered through the Attorney Full general's office, though not always. Nigh states require registration prior to soliciting donations. Furthermore, while most states recognize the federal 501(c)(3) condition every bit valid for state corporate tax exemption – California and Texas are large exceptions. They both require their own application process for charity status in their state.

Step 8: Ensure ongoing compliance

In one case you've obtained the 501(c)(three) status, you lot do not demand to file any kind of document to renew the awarding. In other words, at that place is no expiration date on a 501(c)(3) organization. However, there are other actions that demand to be taken to maintain tax-exempt status.

Once the state approves everything, you should prepare for annual reporting requirements.

In most cases, an exempt arrangement must file some version of Grade 990 with the IRS, depending on its financial activity. Form 990 shows your finances, activities, governance processes, directors, and primal staff, and it is open up to public inspection.

Keep acceptable accounting records of income, expenses, assets, and liabilities. Yous also need to go along appropriate records for employees, such as payroll records and payment of withholding taxes, workers' compensation, unemployment taxes, etc. If you hire whatsoever independent contractors, you need to go on copies of whatever Miscellaneous Income (Form 1099-MISC) documents that are provided to them.

States have their own reporting and renewal requirements too. Therefore, consider tracking your organisation'due south finances and activities throughout the year. This volition help the reporting happen smoothly.

Should yous wish to change your name or address in the future, the IRS mandates that an exempt organization must report the proper noun, address, and structural and operational changes. When an organization files an annual return (such every bit form 990 or 990-EZ), it must report the changes on its return. If your organization needs to report a change of name, come across Change of Proper noun- Exempt Organizations. If you need to report a change of address, see Change of Address – Exempt Organizations. The EO Determinations Office tin issue an affidavit letter showing an organization's new name and/or accost and affirming the section of the Internal Revenue Code.

Recommendations:

Many recommend keeping a corporate record volume where you lot keep all critical documents (including registration papers, licenses, and permits, meeting minutes, etc.) to ensure you're well-organized and fully compliant.

Furthermore, nigh experts recommend that you do non fundraise until you've received yourletter of decision from the IRS stating that you are now tax-exempt.

If yous receive a proposed denial of taxation-exempt condition and you wish to appeal, consider seeing a lawyer with feel of working with nonprofits.

Pro tip: Bank check with your state department of consumer diplomacy (or similar land licensing agency) for information apropos state licensing requirements. For instance, if you sell anything to consumers, you'll need a sales tax permit, and your activities may crave a zoning permit.

Step 9: Get Donations

As a 501c3, donors to your organization can now receive tax deductions for their gifts. Nonprofits have several fundraising options, including solicitation letters and events, simply online giving is chop-chop becoming the almost popular and affordable alternative.

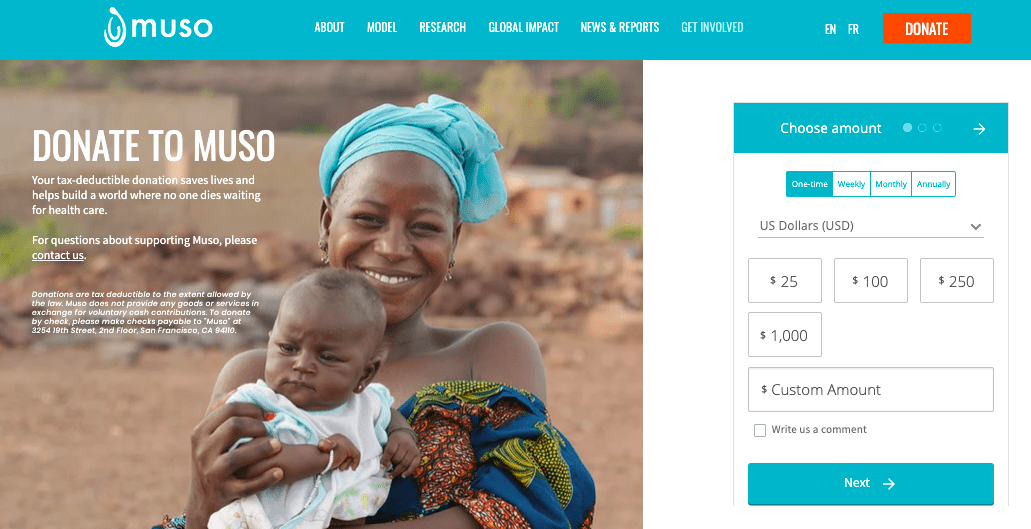

The popularity of online giving is growing, and nonprofits have several options to choose from to collect these donations. Donorbox is one of the easiest and near affordable choices for nonprofits to collect online donations.

For a small-scale 1.5% processing fee on donations and no contracts, Donorbox offers nonprofits custom donation forms, donor management programs, third-political party integration with your electric current website apps, and more than. Below is a listing of why Donorbox stands out from the contest.

Recurring donations

Recurring donations are a fantastic revenue source for nonprofits. These funds tin be depended on and included in your annual upkeep. Donors love the convenience of recurring donations because they can regularly support their favorite organizations without needing to retrieve virtually it. Donorbox gives nonprofits the chance to collect weekly, monthly, quarterly, and almanac recurring donations. Muso is a great example for yous.

Corporate matching with Double the Donation

Donorbox has partnered with Double the Donation to give nonprofits an affordable alternative for company gift matching. Nonprofits can offer their donors an easier way to detect out if their companies offer matching gifts. Integrate Double the Donation on your website and watch your revenue increment.

Crowdfunding

Donors are raising funds through crowdfunding for their birthdays and to help people in need. Nonprofits are hoping to bound on the crowdfunding bandwagon. Donorbox allows nonprofits to create crowdfunding campaigns, send updates to donors, and share successes online. With these customized campaigns, nonprofits tin encourage donors to get involved and share their stories with a new audience. Here's an example –

Text-to-requite

Text-to-give donations are quickly condign a favorite of younger donors and nonprofits. Donorbox gives nonprofits an piece of cake fashion to collect donations using donor smartphones. Local nonprofits, churches, and politicians have all found success with these campaigns.

By sending your donors a text that contains your entrada ID and a link to your donation page, donors can make a former or recurring donation within minutes. Have advantage of how piece of cake this is and add together a text-to-give campaign to your next upshot.

Get Started With Donorbox

What are the benefits of having a 501(c)(3)?

At that place are numerous perks of existence taxation-exempt under Section 501(c)(3).

- Taxation-exempt status: Exemption from federal and/or state corporate income taxes;

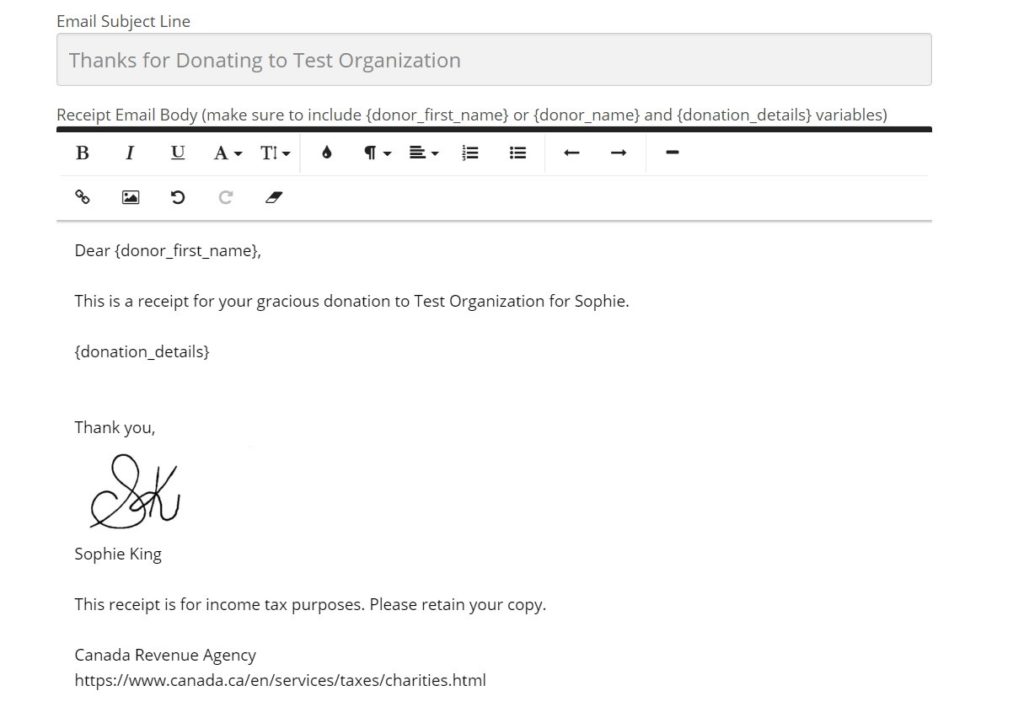

- Deductibility of Donations: Your individual and corporate donors will be able to deduct their donations from their personal and corporate taxes. Your organization can acknowledge and thank its donors past providing tax deduction receipts for cash and not-cash donations.

- Express Liability Protection: Nonprofit corporations provide their founders, officers, and directors with protection against personal liability for the activities of the nonprofit.

- Possible exemption from state sales and property taxes (varies by state)

- Exemption from Federal unemployment revenue enhancement: Potentially higher thresholds before incurring federal and/or state unemployment tax liabilities

- Grant eligibility: Being eligible for grants on federal, state, and local levels. An organization with 501(c)(three) status can also benefit from bachelor private and government grants.

- Discount postage rates and special nonprofit mailing privileges.

- Discounts on publicity: Free or discounted rates for announcements and press releases from nonprofit organizations.

- Online apps at discounted rates: As a registered nonprofit, you can authorize for discounts on many online applications. Here's a detailed list of online apps that provides deep discounts to nonprofits.

- Public legitimacy of IRS recognition: Existence recognized by the IRS equally a 501c3 volition make your organization more official and credible in the optics of the public and other entities.

- Permanent existence: An organization with a 501(c)(iii) status continues to exist even afterward the decease of its founder(s). The moment your organization achieves 501(c)(3) status, information technology is permanent. You'll never have to renew it.

Other perks:

Sure businesses and stores offering discounts to nonprofits and their employees. Some publications also offer nonprofits advertising discounts. Many other businesses and stores readily offering nonprofits and their staff discounts if they're able to present a re-create of their 501(c)(3) condition document issued by the IRS.

Registering 501(c)(iii)Nonprofit – FAQs

1. How much does information technology cost to be a 501c3?

That depends on which IRS form you lot use to file, and you have two options.

- IRS Class 1023-EZ. The user fee for Form 1023-EZ is $275.

- IRS Course 1023 – IRS Grade 1023 is the traditional application method that many new organizations must file with the IRS to obtain their 501c3 tax-exempt condition. The user fee for Grade 1023 is $600.

The user fees must be paid through Pay.gov when the application is filed.

There is as well the cost of hiring an experienced advisor or professional to prepare your 501c3 application Learn in particular about the cost of filing for 501c3 here.

2. How long does it have for a 501c3 to be approved?

Typically, IRS 501(c)(3) blessing takes between 2 and 12 months, inclusive of likely written follow-upwardly questions. Sometimes it takes a footling less; sometimes a little more than.

Filers of Form 1023-EZ experience a shorter time frame due to the streamlined process of e-filing.

1 of the primary reasons for the long review menses is the amount of time it takes for a particular case to be assigned to a review agent. Information technology can as well depend on the time of year, the type and classification of the nonprofit, and the complexity of the application itself.

The expedited review tin can exist requested if a new organization is being formed to provide immediate disaster relief or if a promised grant is substantial relative to the organization's upkeep and the grant has a defined expiration date. However, in that location is no guarantee the IRS will grant expedited review requests.

3. Can you lot be a nonprofit without 501c3?

There are informal nonprofits — those without formal recognition from the IRS — and information technology is entirely permissible for them to remain that way. Even so, without official IRS 501(c)(iii) tax-exempt status, the group is not tax-exempt, and people giving it cannot deduct the amount from their taxes.

Typically, very small nonprofits with annual gross receipts under $5,000, and churches and integrated auxiliaries of churches and conventions or associations of churches operate without 501(c)(3) status. Donations to these organizations are tax-deductible even though the nonprofit does not hold the revenue enhancement-exempt status.

4. Do you have to be a 501c3 to get grants?

Grantmakers typically fund organizations that qualify for public charity status under Section 501(c)(3) of the Internal Revenue Code. There are few grants that are offered to organizations without a 501c3 designation- merely they are few. Nonprofits tin can apply for fiscal sponsorship, a formal arrangement in which a 501(c)(3) public clemency sponsors a project that may lack exempt status. This enables the projection to seek grants and solicit revenue enhancement-deductible donations nether your sponsor's exempt status.

five. Can I donate to my ain 501c3?

Yeah, you tin donate to your own 501(c)(3) system. You lot can make a tax-deductible donation to any 501(c)(3) clemency, regardless of your affiliation with it. It is not technically your ain charity as charitable organizations have no owners. However, money donated to charity must exist used for charitable purposes.

Y'all must make sure that the system gives you a signed receipt for the donation. That indicates what was donated, the value of the donation, and states that no appurtenances or services were received in substitution for the donation.

6. Does a 501c3 pay majuscule gains tax?

Organizations nether Section 501(c)(three) of the IRC are mostly exempt from nigh forms of federal income tax, which includes income and capital gains tax on stock dividends and gains on sales. As long equally the 501(c)(3) corporation maintains its eligibility as a tax-exempt arrangement, it will not have to pay tax on any profits.

7. Does a 501c3 pay property tax?

Properties endemic by charitable nonprofits used for a tax-exempt purpose are exempt from property taxes under state law. If the belongings or any portion of information technology is not used to promote the nonprofit group'southward mission, the group can be liable for property taxes. For instance, if the group owns a holding, just leases part of that holding to a for-profit business. Then the group is liable for property taxes on the leased portion of the holding.

8. What are the 501c3 requirements for a board of directors?

The Board of Directors is the governing trunk of a 501C3 nonprofit, responsible for overseeing the organization'southward activities. The lath is required to ensure that the organisation is legally compliant and is being run in the best possible mode. In a 501c3 organization, the founders may serve on the company's board of directors. Certain states require a 501c3 organization to select at least iii people to serve on the system'south board of directors. And, at to the lowest degree one director in the organization is responsible for making strategic and financial decisions for the organization.

9. How to check 501c3 status?

You tin check the IRS's progress on applications on the IRS website. Once an agent is assigned for your application, your awarding review process will begin. Yous tin check the status of your 501c3 application by contacting the IRS Exempt Arrangement Customer Account Services at (877) 829-5500. Y'all volition need to provide revenue enhancement identification and the mailing accost of the organization. The IRS only provides data regarding the status of your 501(C)(iii) application to an identified officer of the arrangement.

ten. Can 501c3 founders collect a salary?

As a 501c3 founder, you tin pay yourself a reasonable compensation for your actual services in the nonprofit. The IRS examines reasonableness on the basis of comparable salaries in other comparable nonprofit organizations. You lot must be careful to pay yourself reasonable compensation and in lodge to avoid any possible claim for backlog taxes-benefits from beingness paid "as well much". The salary should be within reasonable limits based on the number of hours worked, the overall budget of the organization, the required level of didactics, and compensation averages in your surface area.

11. Are 501c3 Organizations revenue enhancement-exempt?

Yes, All 501c3 Organizations are exempted from federal and/or state corporate income taxes. Although not all activities are tax exempt. Activities that are non related to a nonprofit's core mission or purpose are taxable. This can be whatsoever activeness/business to support a nonprofit's income. Typically, these are categorized as unrelated business activities.

Decision

Without a doubtfulness, the process of establishing a nonprofit is challenging.

It'south advisable that you consult with local expertise (either an attorney, accountant, or someone familiar with the tax-exempt law and how nonprofit organizations operate in your country) to ensure that your new nonprofit complies with land and federal laws and requirements.

An ounce of prevention is worth a pound of cure, and the all-time fourth dimension to set up your nonprofit up for success is at the very beginning.

Hurdles and obstacles should non discourage you lot. Remember why you're doing what you're doing. Come dorsum to your mission and your beneficiaries whenever the procedure becomes a little bit besides much.

We hope this commodity helped you begin to understand the process of incorporating and acquiring the nonprofit tax-exempt status.

We also take dedicated articles for starting a nonprofit in unlike states in the United states of america, including Texas, Minnesota, Oregon, Arizona, Illinois, and more. Check out our nonprofit web log to read them and other nonprofit tips and resources.

Note: By sharing this data we practise not intend to provide legal, revenue enhancement, or accounting communication, or to address specific state of affairs s. The above article is intended to provide generalized fiscal and legal data designed to educate a broad segment of the public. Delight consult with your legal or taxation counselor to supplement and verify what yous learn here.

How Hard Is It To Get 501c3 Status,

Source: https://donorbox.org/nonprofit-blog/how-to-start-a-501c3

Posted by: turnerentinver.blogspot.com

0 Response to "How Hard Is It To Get 501c3 Status"

Post a Comment